‘Digital gold’ thesis difficult to prove as real thing soars, Bitcoin stalls

A massive $1.8 billion wave of liquidations is hitting Bitcoin traders, while gold trades near all-time highs.

- Gold hits new highs as Bitcoin sees $1.8 billion in liquidations.

- Shawn Young, Chief Analyst at MEXC Research, notes that the recent selloff serves as a classic reminder of crypto’s structural fragility.

- In a comment for Coin Insider Daily, Young noted that 407,000 traders faced liquidations as Bitcoin (BTC) fell below $112,000.

Gold and Bitcoin are once again showing divergent trajectories. While gold reached a new all-time high of about $3,790 per ounce on Sept. 23, Bitcoin trended downward over the past week.

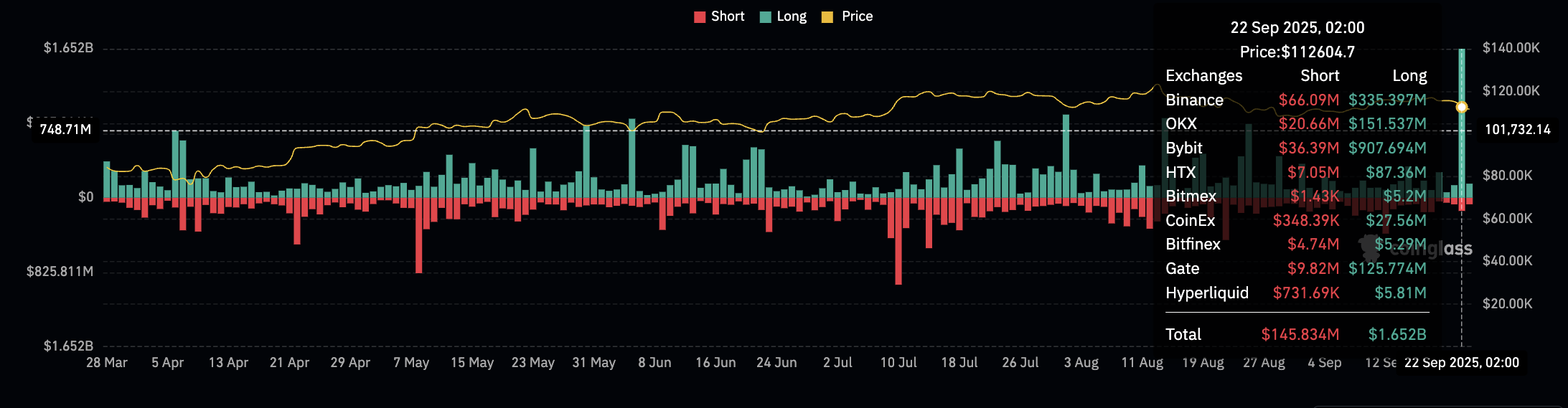

Compounding this trend was a massive $1.8 billion liquidation wave for Bitcoin traders, out of which $1.65 billion was in long positions. The divergence has called into question the narrative that Bitcoin serves as a hedge against macro risk.

According to Shawn Young, Chief Analyst at MEXC Research, the recent selloff is a classic reminder of crypto’s structural fragility when leverage builds up. In a comment for Coin Insider Daily, he noted that 407,000 traders faced liquidations as Bitcoin (BTC) fell below $112,000.

“The U.S. dollar regained strength after the Fed’s rate cut, catching markets off guard. That strengthened dollar, combined with high Treasury yields and looming inflation data, has kept crypto markets defensive,” Shawn Young, MEXC Research.

Bitcoin drops, gold thrives on macro uncertainty

Still, gold and Bitcoin diverged in their reactions to the dollar’s strength. Farzam Ehsani, CEO and co-founder of VALR, told Coin Insider Daily that this is likely due to gold’s more entrenched position as a hedge against geopolitical risk.

When the dollar is strong, Bitcoin often struggles to fulfill its ‘digital gold’ thesis, Ehsani noted. “The sharp divergence between gold and Bitcoin reflects shifting priorities. Gold has surged due to central bank accumulation and its entrenched status as a geopolitical hedge, while Bitcoin remains in early stages of institutional uptake.”

Geopolitical tensions favored gold more in 2025, and the asset was up 42.7% so far this year, according to StatMuse. During that same period, Bitcoin returned just 20.7%, despite major tailwinds in regulations and institutional adoption.