$1.3b BTC left exchanges, bulls deny losing $60k

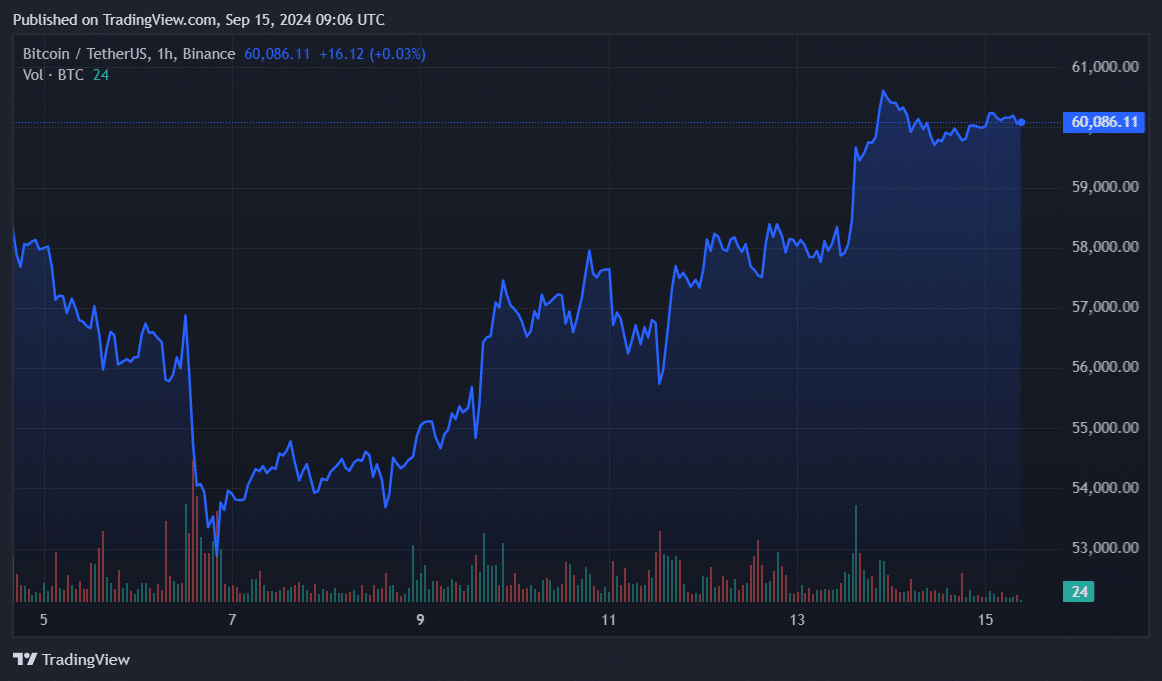

Bitcoin’s surge above the $60,000 zone has triggered an uptick in outflows from centralized exchanges as investors expect further bullish momentum.

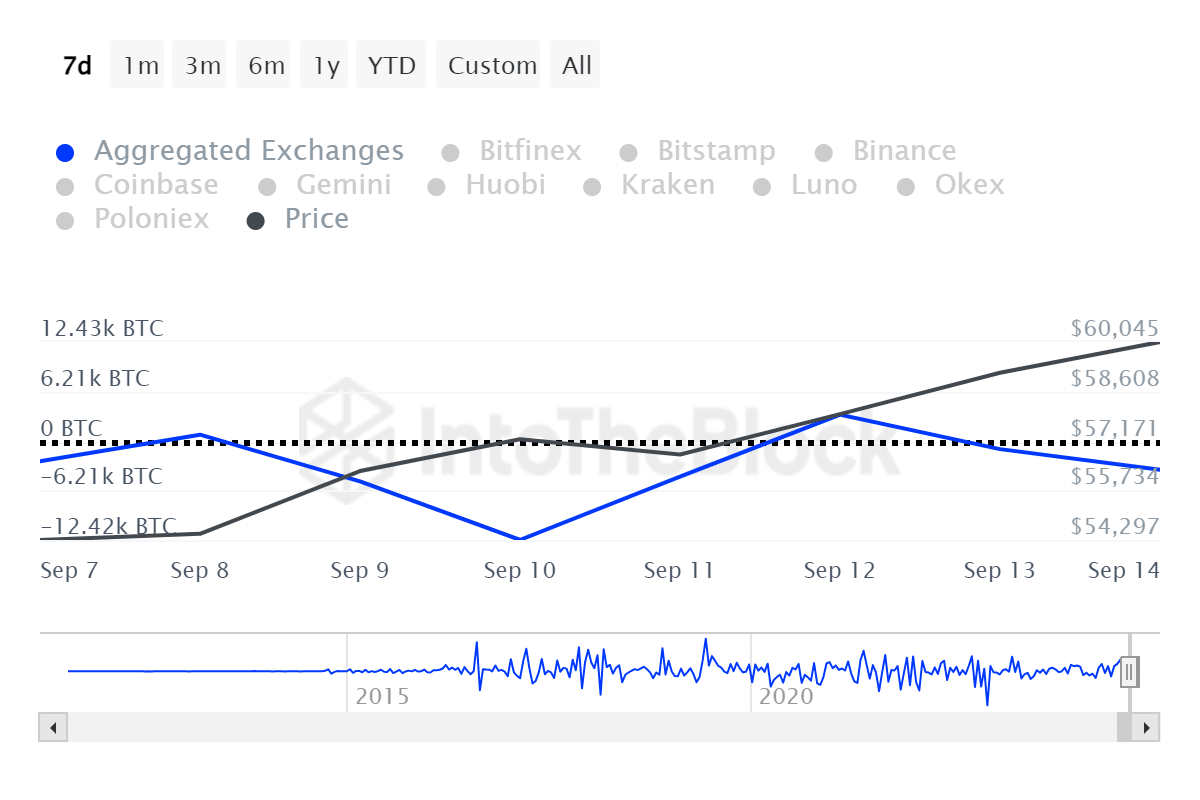

According to data provided by IntoTheBlock, Bitcoin (BTC) witnessed $1.29 billion in net outflows from CEXs over the past week. The movement shows increased accumulation as most on-chain signals look bullish for the flagship cryptocurrency.

Most of the outflows, around 12,420 BTC, came on Sept. 10 when the asset’s price struggled below the $57,000 mark, per ITB data.

Notably, the large holders’ net flow to exchange net flow ratio shows that Bitcoin holders started profit-taking on Sept. 13 as the price reached $60,000 after falling to a local bottom of $52,600.

Bitcoin witnessed a large holder net outflow of 9,180 BTC on the same day. The on-chain movement shows a massive selloff by whales, sending the asset’s price below $60,000.

Expect lower price volatility

According to a Friday report by Coin Insider Daily, MicroStrategy purchased 18,300 BTC for roughly $1.11 billion despite the whales’ selloff.

However, the trend soon shifted to accumulation again on Saturday, Sept. 14, with the ratio reaching 0.43%, according to ITB.

The large holders’ net flows bounced to the positive zone, with 3,240 BTC in net inflows yesterday.

Bitcoin gained 0.2% in the past 24 hours and is trading at $60,100 at the time of writing. The asset’s market cap is currently sitting at $1.86 trillion. BTC’s daily trading volume, however, decreased by 57%, reaching $13.7 billion.

At this point, lower price volatility would be expected for Bitcoin as the price consolidates close to the psychological $60,000 zone. However, a decline below $59,000 could trigger a high amount of liquidations, leading to another potential downfall.